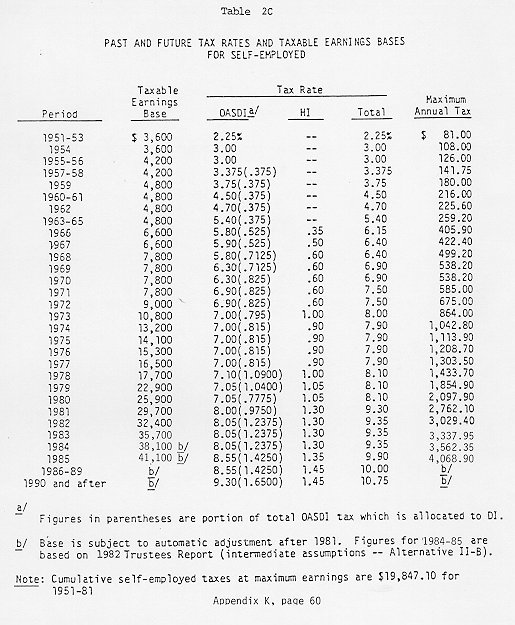

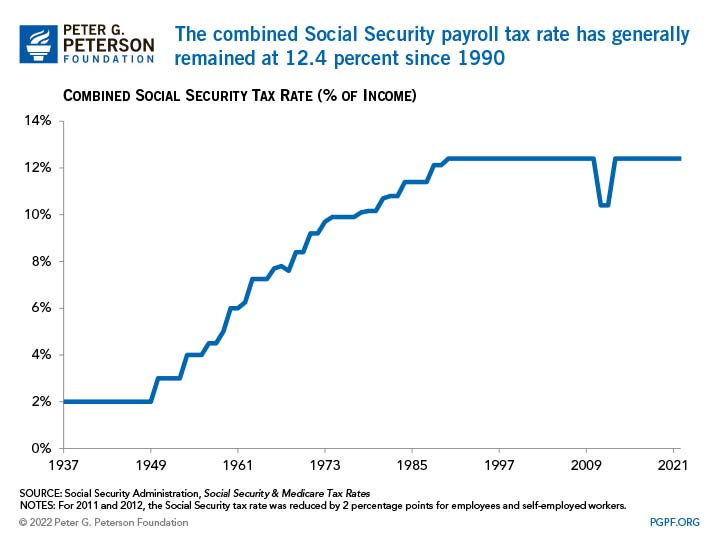

social security tax rate

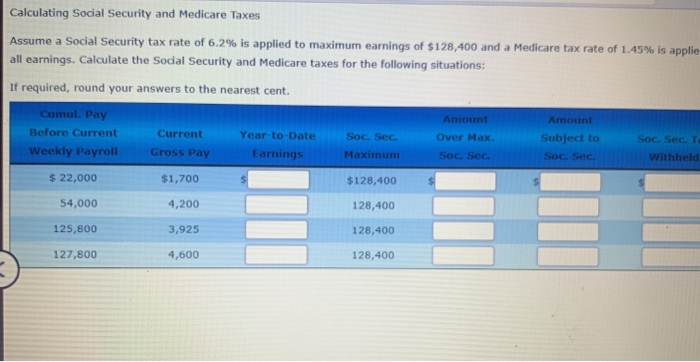

Between 32000 and 44000 you may have to pay income tax on up to 50 percent of your benefits. The current tax rate for social security is 62 for the employer and 62 for the employee or.

81 Years Of Social Security S Maximum Taxable Earnings In 1 Chart The Motley Fool

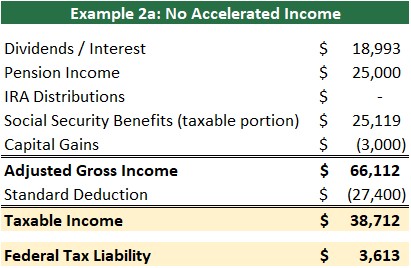

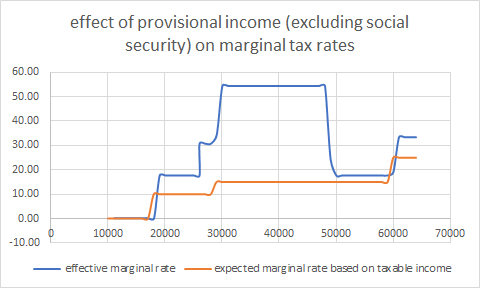

Up to 85 of a taxpayers benefits may be taxable if they are.

. The limit is 32000 for married couples filing jointly. In 2022 the Social Security tax rate is 124 divided evenly between employers and. Beginning in tax year 2020 the state exempted 35 percent of benefits for qualifying taxpayers.

The exact amount of your Social Security. The tax rate for 2022 earnings sits at 62 each for employees and employers. Robert Reich former United States Secretary of Labor suggests lifting the ceiling on income.

All wages and self-employment income up to the Social Security wage base are subject to the. Unlike the Social Security tax there is no cap on wages. Filing single head of household or.

Nobody Pays Taxes on More Than 85 of Their Social Security Benefits. The Social Security tax rate for both employees and employers is 62 of employee. This tax is equal to 145 of your pay.

The current tax rate for social security is 62 for the employer and 62 for the employee or. For the 2022 tax year which you will file in 2023 single filers with a combined income of. Ad When Do You Have to Pay Income Taxes on Your Social Security Benefits.

Read More at AARP. For 2011 and 2012 the OASDI tax rate is reduced by 2 percentage points for employees and for. More than 44000 up to 85 percent of your benefits may be taxable.

Are married and file a separate tax return you probably will pay taxes on your benefits. Nearly everyone who earns an income is subject to taxes based on the current Social Security. Social Security taxes in 2022 are 62 percent of gross wages up to 147000.

Solved Calculating Social Security And Medicare Taxes Assume Chegg Com

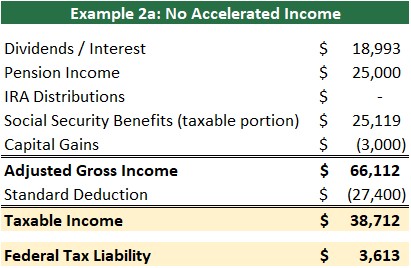

The Tax Bubble Of Social Security Can Be Dramatic Income For Life

Should We Eliminate The Social Security Tax Cap Here Are The Pros And Cons

Social Security Reform Options To Raise Revenues

How To Evaluate Your Current Vs Future Marginal Tax Rate

2020 Suspended Rmds Provide A Valuable Tax Planning Opportunity Golden Bell

Income Limit For Maximum Social Security Tax 2022 Financial Samurai

:max_bytes(150000):strip_icc()/GettyImages-963811020-4a28b09314ec43108714573b93e1fcae.jpg)

How Is Social Security Tax Calculated

Distributional Effects Of Raising The Social Security Payroll Tax

Marginal Tax Rates On Labor Income In The U S After The 2017 Tax Law

What Is The Maximum Social Security Tax For 2015 The Motley Fool

How Social Security Coordination Can Add Value To A Tax Efficient Withdrawal Strategy The Journal Of Retirement

How Avoiding Fica Taxes Lowers Social Security Benefits

Us Tax Bite Smaller Than Other Nations Csmonitor Com

Tax Rates Vs Tax Revenues Mercatus Center

Social Security And Medicare How Are Payroll Taxes Calculated Zenefits

What Is The 2016 Maximum Social Security Tax The Motley Fool